Creating value as

a responsible investor

A letter from the Executive Chairman

As a firm with a global footprint, we are keenly aware of the many challenges facing the world and the role that responsible investment can play in overcoming these challenges and in creating value.

This year’s report sets out the steps we are taking to create long-term value, and highlights how we are putting sustainability at the core of our firm, as well as across our investment portfolio.

Mohammed Alardhi

Executive Chairman

Highlights

Climate action

Sustainability Leader

Ranked top 10 sustainability leaders by Forbes ME for the second year in a row

Net zero

Publicly reaffirmed our commitment to achieving net zero emissions by 2050 or sooner

-32%

Achieved a 32% reduction in Scope 1 and 2 GHG emissions in FY23, vs a FY19 baseline, and on track to reach interim net zero target

People and culture

DEI Top 10

Ranked among top 10 in DEI among private equity firms for a third year (2023) by Equality Group

>80%

Piloted DEI maturity framework with majority of European private equity portfolio companies

92%

Achieved a high score in our annual survey for general employee satisfaction

Our approach

Focusing on what matters most

Our sustainability efforts are guided by input and feedback from all our stakeholders, including our clients, employees, shareholders, regulatory bodies, lenders and our Board of Directors.

We continually consult our core stakeholders on their views and expectations and strive to consider multiple views when establishing our sustainability policies, practices and reporting methodologies.

Climate action

We support the transition to a net zero economy through our investments, portfolio companies and across our own operations.

People and culture

We advocate for more representative and inclusive work environments and support the health, wellbeing and educational advancement of our communities.

Good governance

We build high performing businesses through good governance measures including robust data protection and cybersecurity protocols.

Our principles

Our principles guide everything we do in pursuit of our objective to provide clients with the best investment products and solutions for their needs.

Global outlook

We see opportunity in the major markets where we operate. We provide the local insight needed to understand and leverage every meaningful investment idea for our clients.

Lasting partnerships

Our business is built on the highest level of service. We nurture strong, enduring relationships with our clients and with the management teams we invest in.

Entrepreneurial spirit

We are aligned with our clients. As a principal investor in many ideas, we will often deploy our capital before we offer the opportunity to our clients.

Sound judgement

We are an institution with four decades of experience. We draw on our knowledge to make well-informed decisions in the pursuit of strong and sustained returns.

Sustainable investing

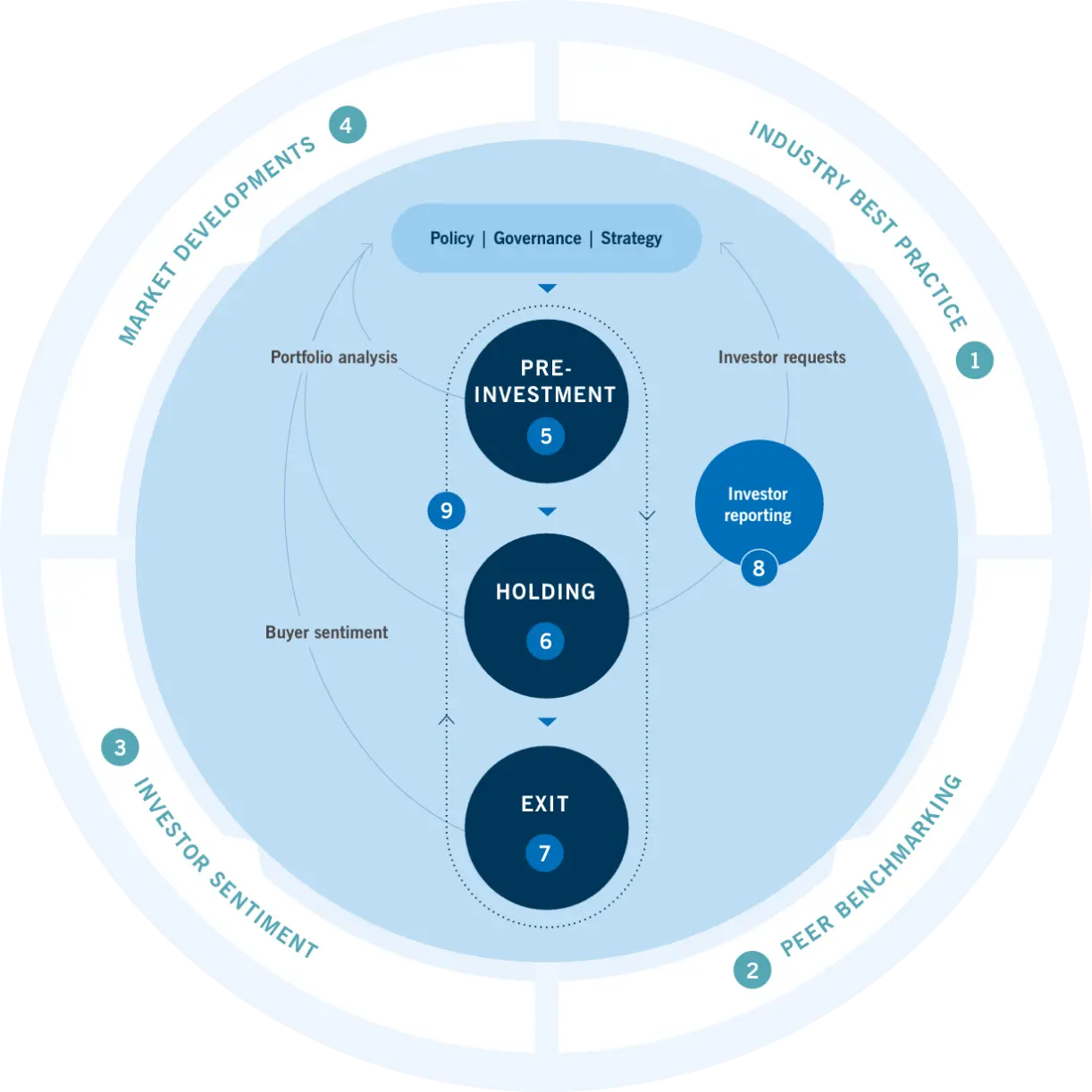

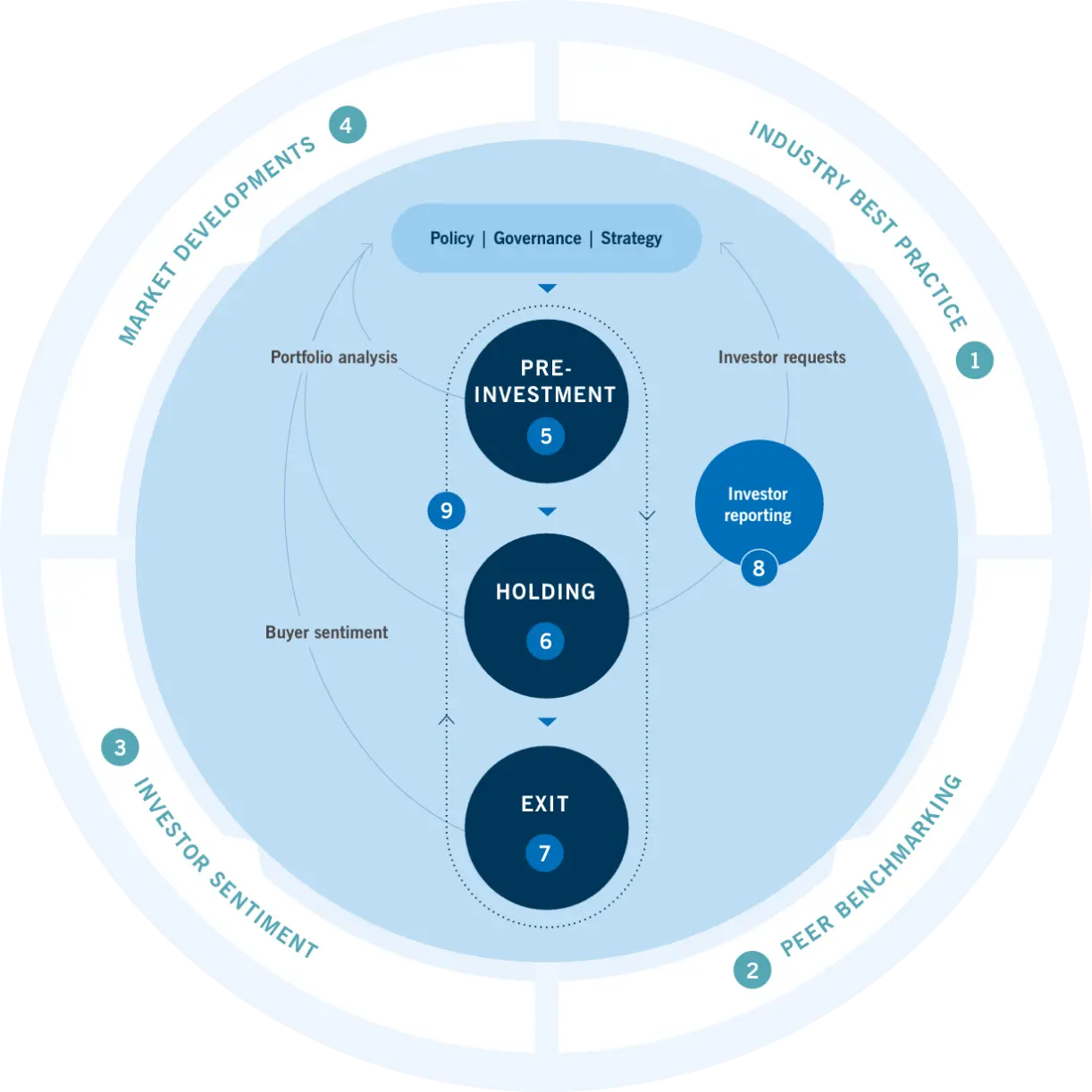

Embedding sustainability in the investment lifecycle

Over the past few years, we have been integrating and improving the way we consider sustainability factors across our investment strategies.

Our approach aims to protect our investments from value erosion due to sustainability factors and unlock additional value. The broad, complex and fast-changing nature of these factors requires flexibility; we use feedback loops throughout our investment lifecycle to stay responsive.

Framework evolution

Industry best practice

We leverage frameworks and pilot new approaches to sustainability from the industry groups we participate in.

Peer benchmarking

We monitor our peers and collaborate where appropriate to remain relevant with industry best practice.

Investor sentiment

We listen to our investors’ feedback and monitor wider market trends to build our understanding of their needs.

Market developments

We stay abreast of wider sustainability news and events to inform our approach and keep on top of emerging issues.

Process development

Screening and diligence

We learn from pre-investment screening and sustainability due diligence performed on target companies.

Engagement and monitoring

We apply learnings from working with our portfolio to feed into investment process considerations and conditions.

Value realization

We seek to assess how sustainability factors support value realization and understand what buyers of our assets value.

Investor reporting

We analyze the due diligence questionnaires and data requests we receive to give us insights into what our investors value.

Investment lifecycle

Iterative investment team feedback enhances our processes; we encourage cross departmental knowledge sharing.