Climate

Developing in-house tools to support climate due diligence

We continue to deepen our understanding of climate risks, covering both physical hazards and transition drivers.

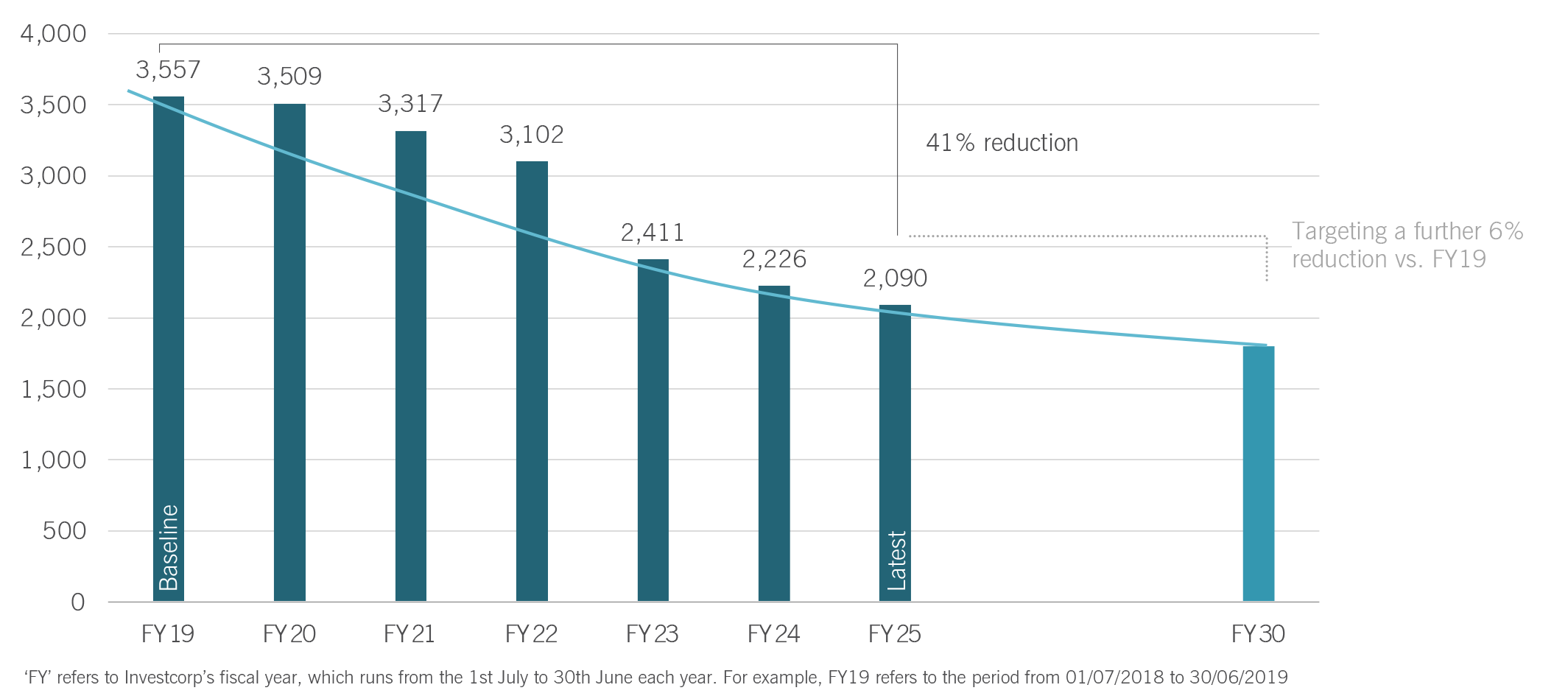

Phase 1 of our approach to managing climate risks focused primarily on transition risks associated with our operations and investments, through structured programs to assess carbon footprints for our corporate activities and our emissions-intensive portfolio companies. While this remains important, the next phase of our climate program will further consider resilience to physical risks across our investments and operations.

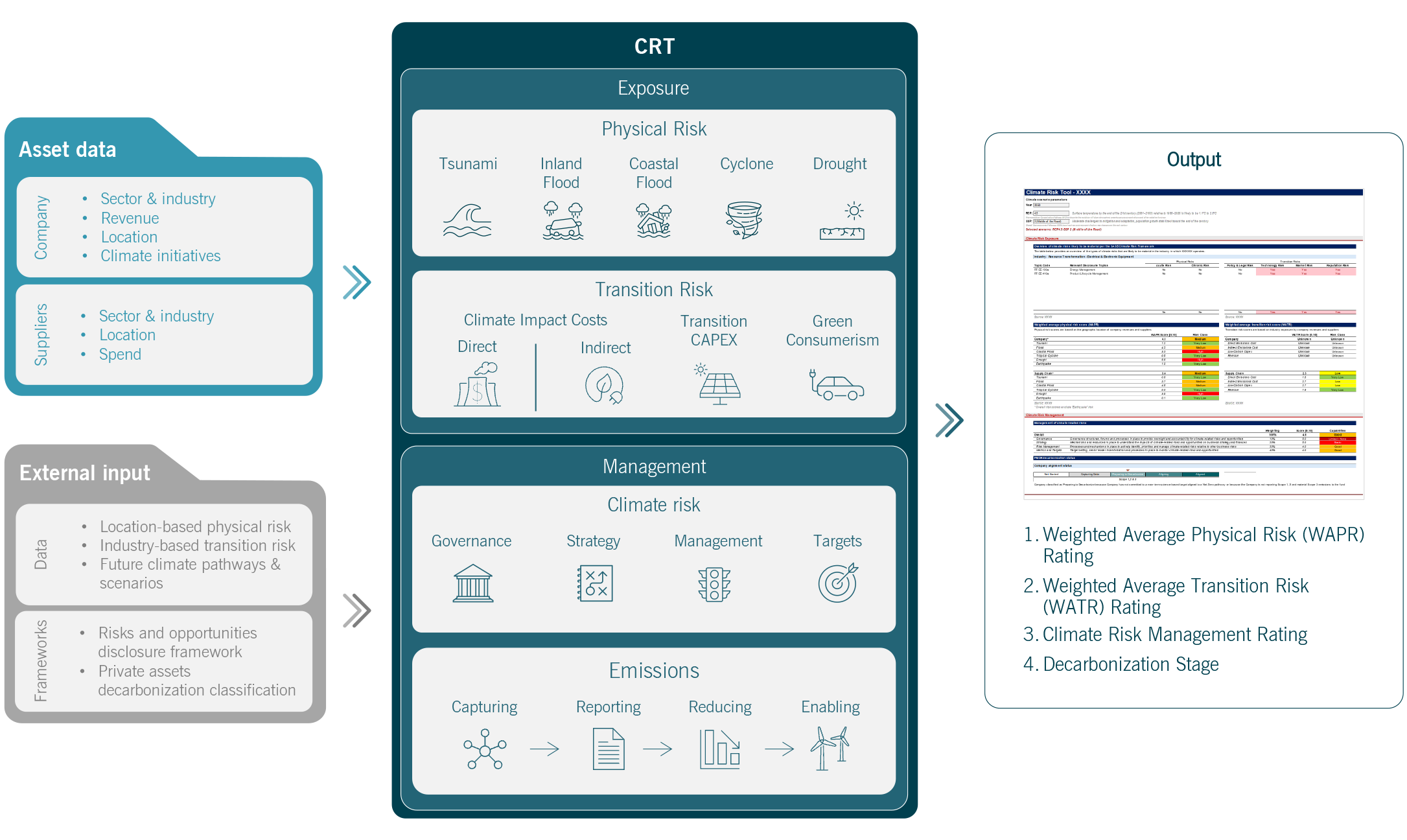

CLIMATE RISK TOOL (CRT)

Consideration of climate-related risks requires tools and processes that support investment diligence. To address this, we developed an internal tool that will be made available to all Private Equity investment teams following a pilot phase, providing a consistent approach for screening of climate-related risks.

The tool is designed to be used during initial assessments, drawing on credible public datasets related to climate exposure and vulnerability. Inputs are calibrated to our use case to help form an early view of potential climate risk exposure for each asset.

Designed for practicality, the tool requires minimal inputs, delivers rapid indicative outputs, and integrates seamlessly into existing workflows – allowing teams to apply it early in the investment process where relevant to do so. Investment teams can prioritize issues and determine where deeper analysis is needed, including engagement with third-party advisors when appropriate.

People and Culture

Advancing shared ownership in middle market private equity

In November 2024, Investcorp’s Strategic Capital Group (ISCG) partnered with Ownership Works, a nonprofit dedicated to expanding employee ownership in the private sector. As the first GP-staking partner of Ownership Works, ISCG is pioneering a model of sustainable value creation that aligns the interests of investors, companies, and employees.

This collaboration underscores ISCG’s commitment to bring institutional tools traditionally associated with large-cap firms to middle-market GPs. As private equity evolves beyond the era of pure financial engineering, GPs are increasingly turning to operational levers to drive value. Shared ownership remains a powerful yet underused tool in the middle market.

Through this partnership, ISCG and Ownership Works provide frameworks and implementation support to help private equity GPs embed these shared ownership programs across their portfolios. These programs are designed to align employee and investor interests, foster stronger performance cultures, and enhance GP differentiation in an increasingly competitive landscape.

84%

decrease in turnover at Ingersoll Rands (19% to 3%) and 71% improvement in the safety incident rate following implementation of a broad-based ownership plan

40%

of Americans cannot cover a $400 emergency expense

$1.3bn

in realized wealth created by Ownership works since 2021, with over $10bn in projected wealth to come through shared ownership programs still underway

Governance

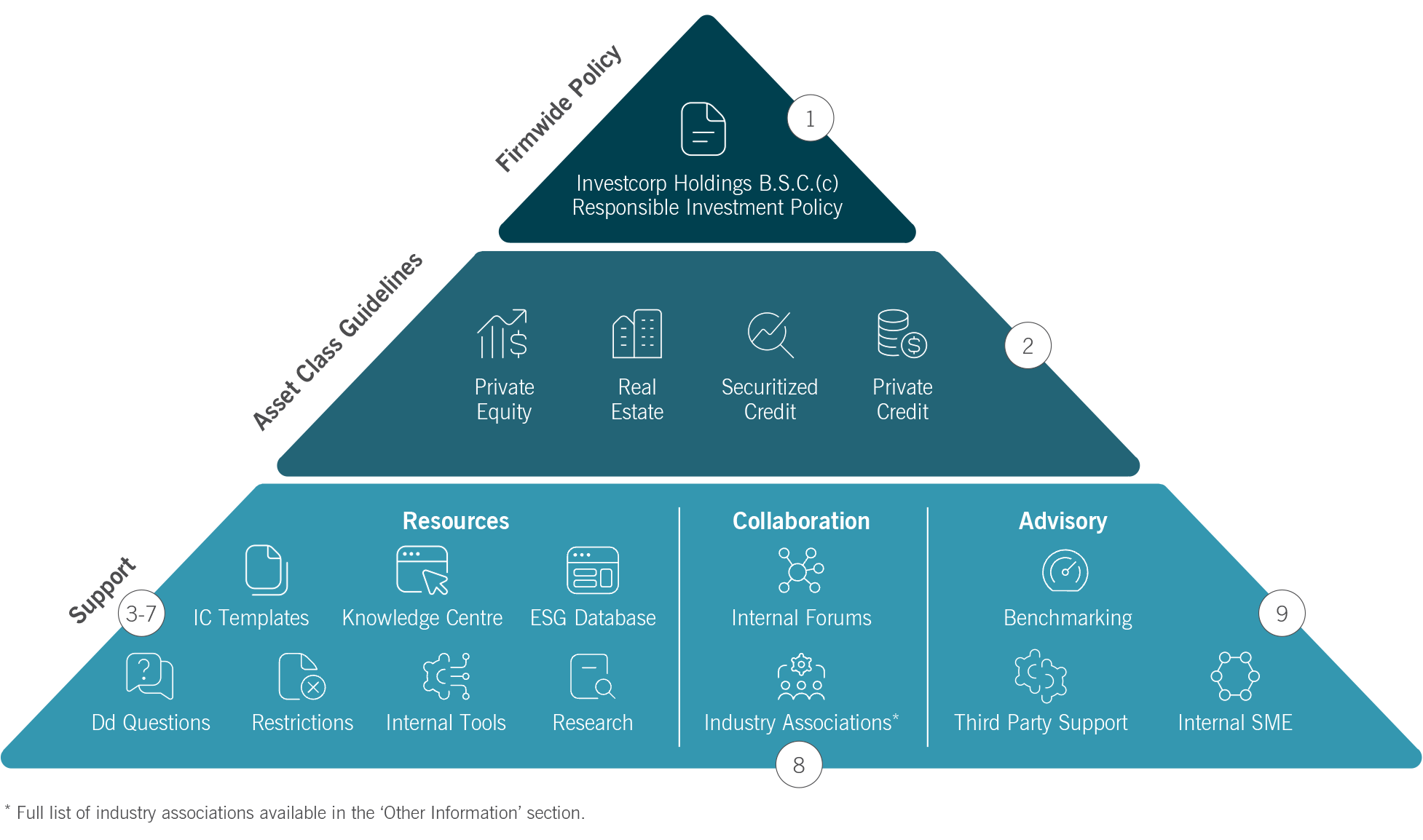

Sustainability integration in the investment process, updated for today’s market

In late 2024, we launched an initiative to review our existing policies, focusing on four key questions:

- What is best practice? We benchmarked peers, consulted industry associations, and engaged our broader network to identify emerging standards.

- What do investors want? We reviewed past due diligence questionnaires, investor meeting notes, and consulted our capital raising teams to understand disclosure preferences and priorities.

- What is practical? We engaged investment teams, operating partners, and drew on day-to-day portfolio engagement to calibrate a pragmatic approach.

- What does the Firm need? We worked with Internal Audit to identify critical controls, aligned with Investment Risk on lifecycle interactions, and ensured consistency with the Firm’s overall strategy.

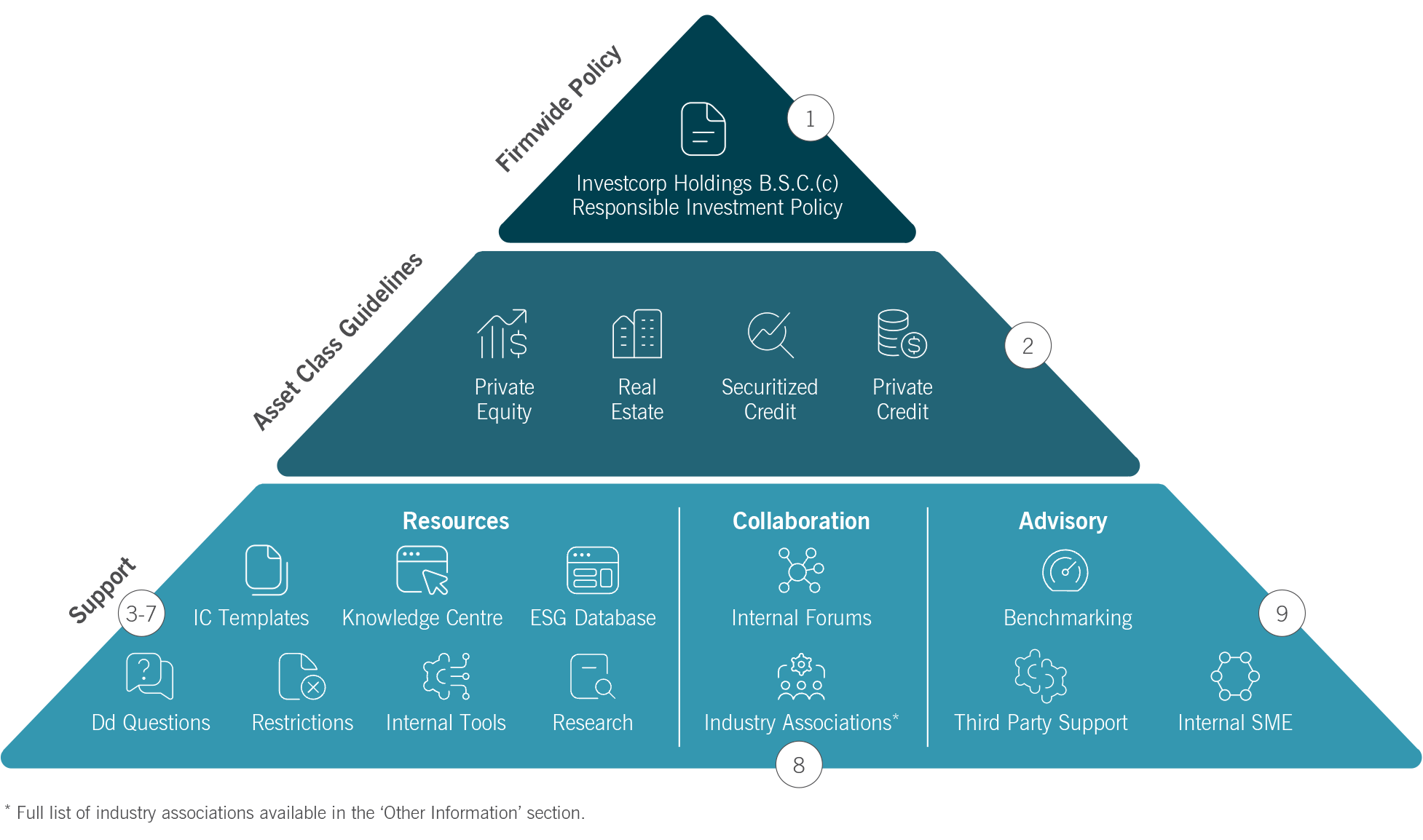

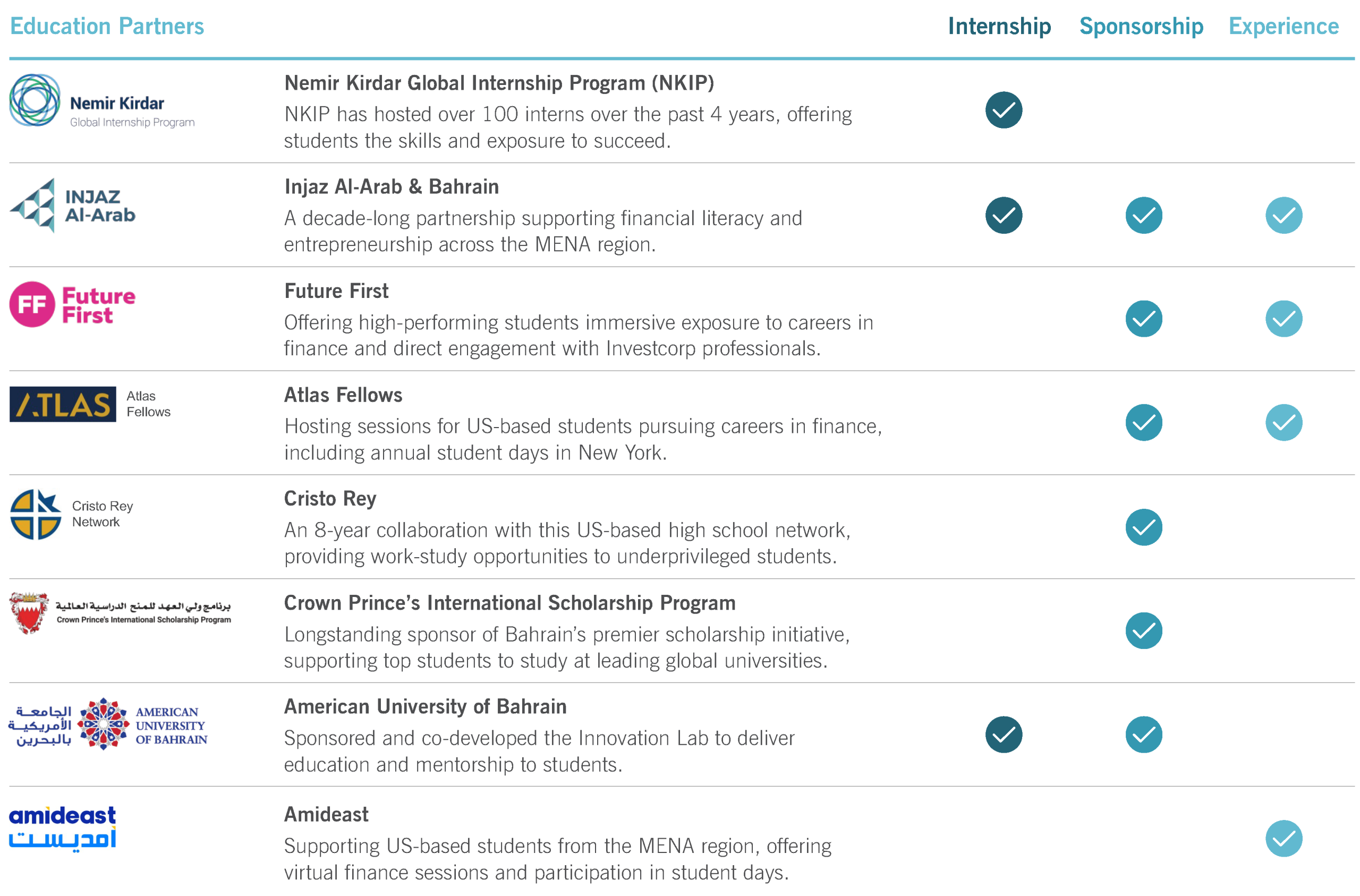

OUR UPDATED POLICY SUITE

We are working with each investment team to embed the suite consistently and to measure adoption through our regular governance processes. Collectively, these updates aim to improve clarity, strengthen accountability and make sustainability integration more decision useful.

-

- Firmwide Responsible Investment Policy brought in line with current industry best practice and remains publicly available on our website.

- Existing procedures and guidelines for each core asset class updated to clarify process and expectations, including improved guidance on reporting, significant-incident escalation, and documentation of sustainability-related initiatives.

- Standardized Investment Committee (IC) templates for Private Equity, Real Estate and Private Credit introduced across geographies to support consistent consideration of sustainability factors.

- Proprietary tools using publicly available datasets developed to provide clear, decision-useful insights within pre- and post-acquisition.

- Sample due diligence questions against our core focus areas provided to help teams scope work with third-party advisors.

- Investment Restrictions Framework revised for relevant LOBs, clearly defining prohibited activities, revenue thresholds, and escalation requirements.

- Refreshed knowledge hub consolidates all policies, tools, templates, and case studies in one accessible location, making it easier for teams to apply the updated framework in practice.

- Industry associations participation and internal forums foster stronger collaboration and promotes knowledge sharing across teams and geographies.

- Internal and external subject matter experts (SMEs) and advisors, complemented by access to benchmarking capabilities to compare performance.

Governance

Utilizing industry associations to improve practices

Since 2021, Investcorp has been a signatory of the United Nations Principles for Responsible Investment (UN PRI), formalizing a commitment to responsible investment that has been part of our Firm’s approach for over four decades.

This alignment reflects both our investor’s expectations for high sustainability standards and our strategic intent to benchmark against global best practices. In addition to leveraging resources from other industry associations we are members of, we apply the PRI framework to evaluate and strengthen our approach across all core investment lines – Private Equity, Real Estate, and Credit (both securitized and private) – as well as firmwide policy, governance, and strategy. Our latest disclosure highlights progress and consistency across reporting modules, with most scores exceeding the PRI median and an average increase of 2 percentage points compared to the previous reporting period.

Port of Duqm

Infrastructure for impact, supporting Oman’s net-zero ambitions

In 2025, Investcorp Aberdeen Infrastructure Partners (AIIP) signed a development agreement of $500 million to expand Oman’s Port of Duqm, a strategic deep-sea port on the Arabian Sea. This commitment supports Oman’s Vision 2040, contributing to the goal of reaching carbon neutrality by 2050.

The planned expansion includes dredging, quay wall construction, and marine infrastructure to support a pioneering green steel plant powered by hydrogen. This facility will produce low-carbon iron metallics, positioning Duqm as a hub for sustainable industrial innovation.

The project also aligns with broader regional goals of economic diversification and climate resilience. By enabling low-emission manufacturing and enhancing trade infrastructure, the Port of Duqm is set to become a model for sustainable development in the Gulf.

Investcorp’s involvement reflects its strategy of backing infrastructure that delivers long-term economic value as well as environmental impact. This project will help catalyze green technology adoption and support Oman’s transition to a low-carbon economy.

Eficode

Setting targets as part of sustainable value chains

In 2025, Eficode – a leading consultancy enabling organizations to develop quality software faster through training, advisory, and support – began setting Science-Based Targets initiative (SBTi) emissions goals. This step was driven by both evolving regulations and, crucially, by large enterprise clients who required decarbonization targets from their value chain partners to maintain preferred supplier status.

Eficode recognized that, even as regulatory timelines shifted, client expectations for credible ESG action would remain high. By proactively aligning with SBTi and the principles of the European Sustainability Reporting Standards (ESRS), Eficode are positioning themselves to continue serving as a trusted partner to its most important customers.

Although still in its early stages, this initiative has already demonstrated strong potential to deliver tangible benefits by deepening relationships with major clients. The process of setting and tracking emissions targets also has the potential to drive internal improvements, such as energy efficiency initiatives, which can reduce operational costs over time.

Eficode’s agile, stakeholder-focused ESG strategy is flexible and data-driven, prioritizing the needs of customers. Transparent ESG action will further enhance Eficode’s reputation as a responsible, forward-thinking company supporting both client trust and talent attraction.

RESA Power

Aligning people and performance through employee ownership

Our April 2025 exit from RESA Power underscored the strategic value of inclusive business practices. Over a three-year period, RESA’s Revenue and EBITDA grew more than fourfold, driven by strategic expansion, digitization, and a pioneering employee ownership initiative.

Under Investcorp’s stewardship, RESA introduced an industry first Employee Ownership Program, granting equity to all employees with at least one year of service. This initiative fostered a culture of shared accountability and long-term thinking, aligning employee incentives with business performance. As a result, RESA’s workforce expanded from 200 to over 800, with high levels of engagement and retention.

During this time, the company also invested in machine learning and AI to enhance service delivery, supporting its role in the electrification of infrastructure across North America. RESA’s services – ranging from transformer maintenance to life extension solutions – are critical to sustainability, grid modernization and the transition to a low-carbon economy.

Investcorp’s exit delivered a >5x return on invested capital. Importantly, RESA’s management and employee shareholders retained a minority stake, ensuring continuity and reinforcing the sustainability of the ownership model.

Anchorage

Anchorage’s role in sustainable real estate

Anchorage One and Two, located in Salford Quays, Greater Manchester, was featured in last year’s report for its advanced smart building management system and innovative energy systems.

Building on this recognition, Anchorage One and Two recently underwent a comprehensive BREEAM In-Use assessment, achieving an “Excellent” score in Management Performance (75%)—the highest result achieved in Greater Manchester—and a “Very Good” score in Asset Performance (57%). The assessment highlights the building’s outstanding sustainable characteristics.

The building excelled in categories such as Management (82%), Health & Wellbeing (64%), and Land Use & Ecology (80%). These high scores were achieved in part due to a proactive approach to engaging with tenants, ensuring their needs and feedback directly inform building operations and community initiatives. High scores in Water (88%) and Resilience (100%) further demonstrate a holistic approach to sustainability that benefits both people and the environment.

Achieving high sustainability certifications like BREEAM not only demonstrates environmental and social responsibility but also enhances the asset’s attractiveness to investors. Certified buildings are increasingly favored in real estate portfolios for their lower operational risks, improved tenant satisfaction, and alignment with ESG (Environmental, Social, and Governance) approaches.